5 min read

The Future of Customer Loyalty: Using data to inform your planning

The latest audience data from TRG Arts, showing what patrons care about right now and how their values have changed.

Eric Nelson, Client Engagement Officer at TRG Arts, looks for a clear direction forward, to demonstrate what the future of customer loyalty can and should look like in 2023 and beyond. Using TRG Arts' Arts and Culture Benchmark, he brings together real-time intelligence from over 400 organizations and 335 million transactions across North America, the UK, and Ireland.

This content was first presented in February 2023 as part of The Future of Patron Loyalty, a panel event hosted by Spektrix. If you missed out, we've now published the full event online - helping you to explore what customer loyalty means for theatres, cultural venues and touring organisations in the post-pandemic world.

"We need a different approach"

This is a common statement and desire I hear when talking with arts administrators. However, there isn’t an easy answer or a clear direction forward regarding what the future of customer loyalty can and should look like. To help us puzzle through it, I would like to share some data around what patrons care about right now and how their values have changed, using data from TRG Arts’ Arts and Culture Benchmark.

Customer experience values

Before examining the Arts and Culture Benchmark data, I first want to highlight some research being done in our sector to help define customer needs and motivations of today.

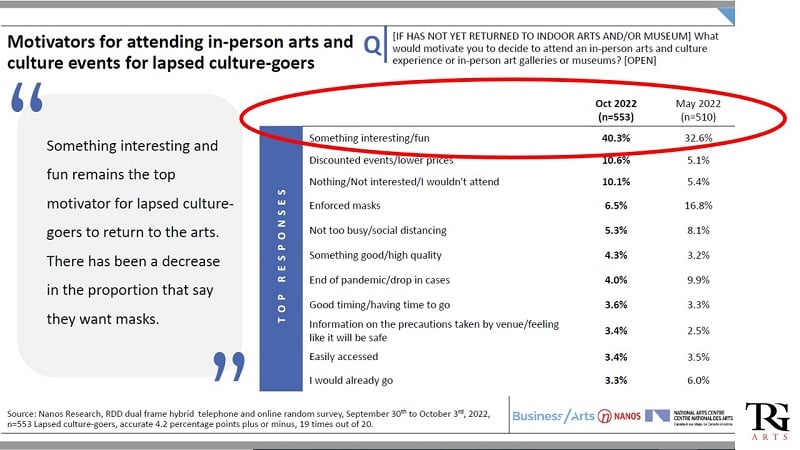

So, what has motivated lapsed arts and culture customers to return to live performances?

- “Something interesting and fun,” ranks first according to a recent report by Nanos Research that tracked customer attitudes in both May and October of 2022.

- In that same study, mask enforcement and drops in pandemic cases are becoming less relevant.

- Concerningly, the selection of “Nothing/Not Interested/I wouldn’t attend” rose by almost 5%.

- Focussing on programming and special offers for lapsed customers in your database are the two strategies helping to encourage them off their couches.

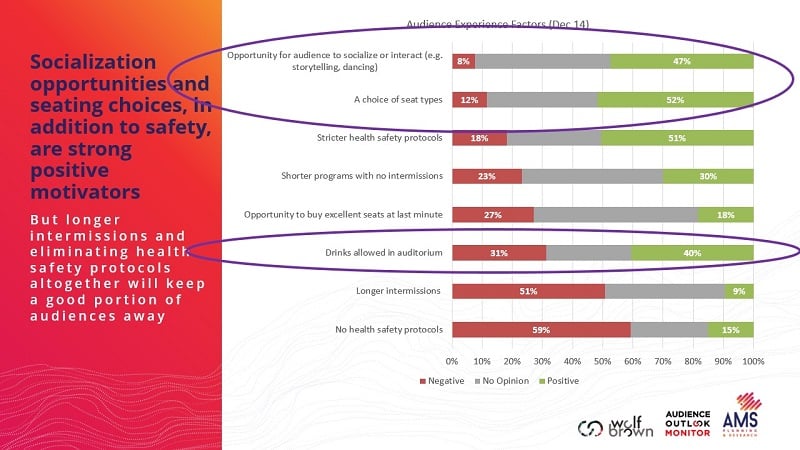

A similar but different way of looking at motivations is by understanding what audiences value in their experiences at your venue.

- The top experience factors found by a Wolf Brown survey were socialisation opportunities and seating choices.

- Long intervals and no safety protocols were the two most negatively perceived items in the survey.

- The most divisive experience was drinks being permitted in the auditorium, with 31% feeling negative about it and 40% feeling positive, with the remainder having no strong opinion on it.

Finding ways to offer your audiences the seats of their choice and opportunities for additional socialisation around your events are ways to meet and market to their values. Surveying your own audiences will give you even greater clarity on how to form your offerings around the experiences they are seeking.

Audiences have embraced the flexibility and convenience that virtual tools can provide, but they are still desirous of real-life experiences and escapes. Consumers have emerged from the pandemic with new clarity on their individual priorities as well, requiring personalisation and relevance on the part of the brands and organisations they choose to spend their money with. Taking actions on things like sustainability and diversity are some of the commonly found values from research by Google, but here again is an opportunity to ask your audiences directly about their priorities and show them where your work aligns with their values.

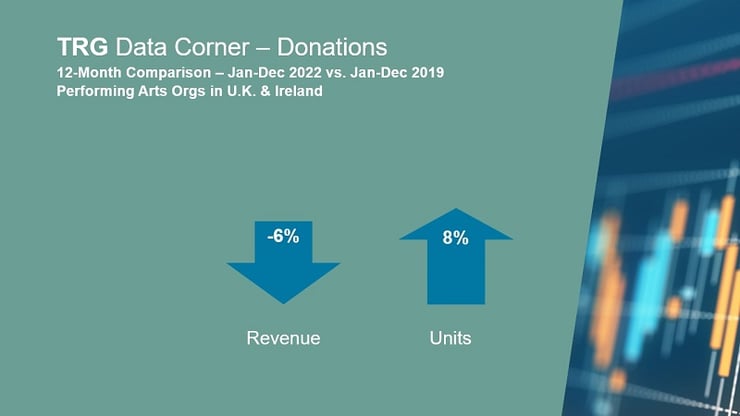

Data corner: UK and Ireland

Ticket sales and donations: 2022 v 2019

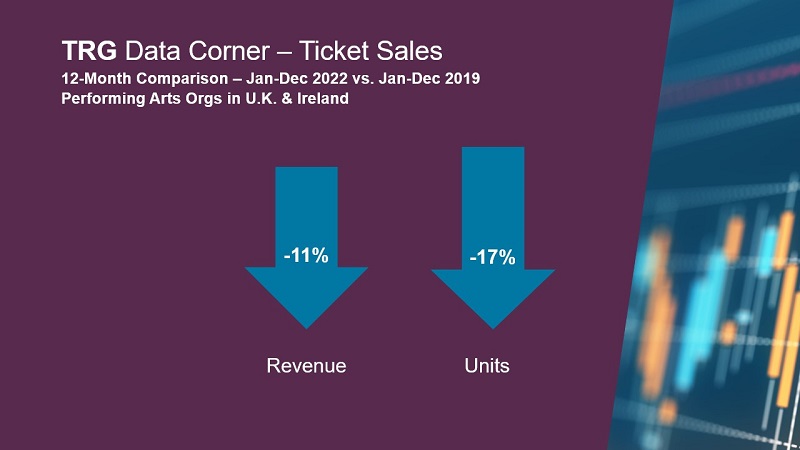

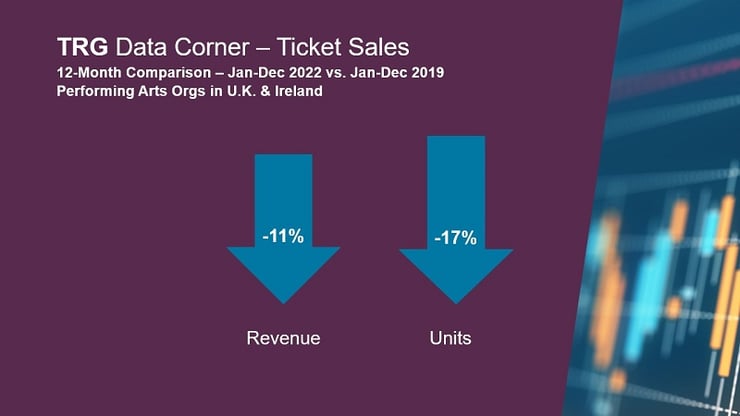

Performing arts ticket sales for 2022 in the UK and Ireland were down in both revenue and units compared to 2019. Revenue has fallen less than units, which may reflect a slight increase in the price of tickets since 2019. On the donations side, units rose 8% in 2022 but revenue from donations was down by 6%.

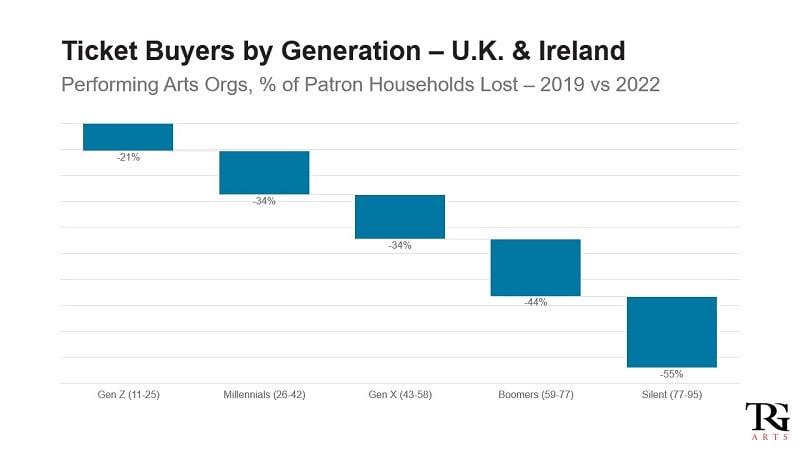

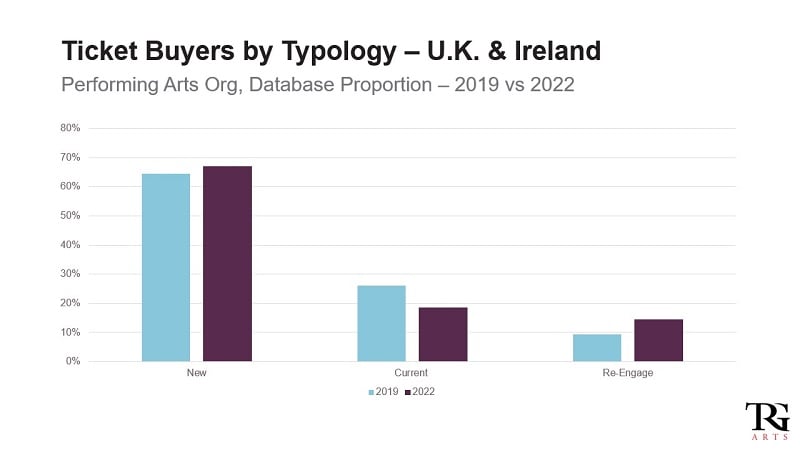

Audience demographics: Age and booking habits

Performing arts organisations in the UK and Ireland have lost a high percentage of households in the older generations who previously attended arts events. The greatest loss, -55%, was in the Silent generation (age 77-95). Only 21% of Generation Z (age 11-25) were lost as audience members from 2019-2022.

Encouragingly, new buyers are making up a greater percentage of overall ticket purchases in 2022 than in 2019, as are re-engaged buyers. The overall percentage of current buyers however, is down by roughly 10%.

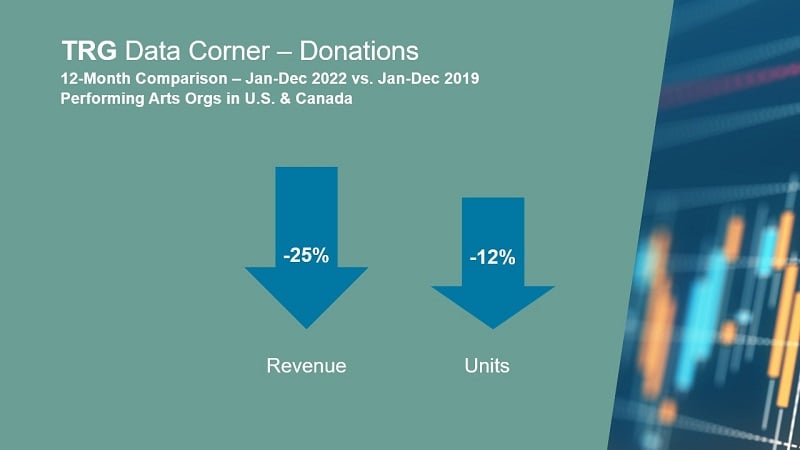

Data corner: US and Canada

Ticket sales and donations: 2022 v 2019

North American performing arts ticket sales in 2022 were down in both revenue and units compared to 2019. Revenue fell by 7% less than units, which may reflect a slight increase in the price of tickets since 2019. On the donations side, units fell 12% in 2022 from 2019 and revenue from donations was down by 25% due to a large reduction in end of calendar year giving.

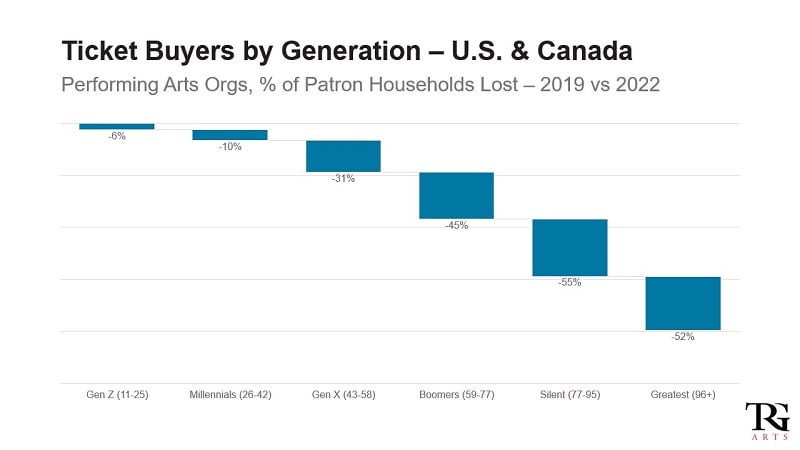

Audience demographics: Age and booking habits

Performing arts organisations in the US and Canada have lost a high percentage of households in the older generations who previously attended arts events. The greatest loss, -55%, was in the Silent generation (age 77-95), with a -52% reduction in the Greatest generation (age 96+). Only 6% of Generation Z (age 11-25) and 10% of Millennials (age 26-42) were lost as audience members from 2019-2022.

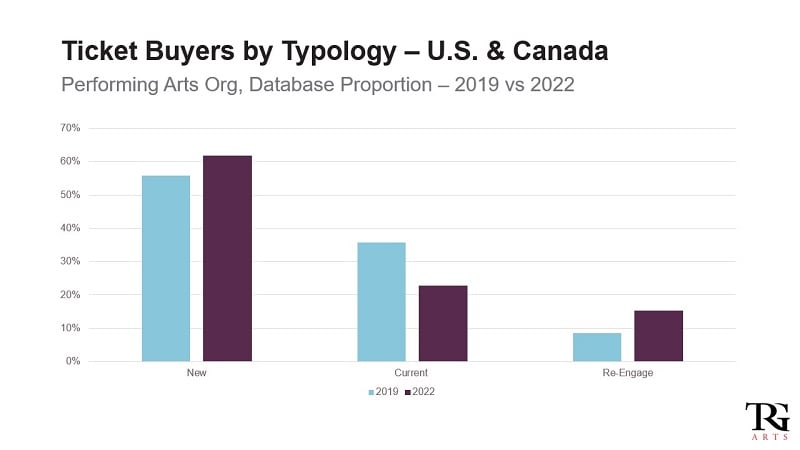

Encouragingly, the percentage of new buyers, compared to overall ticket sales, was higher in 2022 than in 2019. The same trend was true for re-engaged buyers. One of the present challenges seems to be getting current patrons who have come back in 2022 to become repeat buyers.

Focus areas for 2023

So that gets us back to wanting, needing a different approach.

Or does it?

Building the loyalty of your customer has always been and will continue to be what sustains your organisation for the future. Investing in loyalty, retention, and building frequency are the needed ingredients.

How do you move forward?

There are immersive tools and technologies everywhere to help you better steward your customers and understand their values. While most totals in 2022 were still down from pre-pandemic levels, the 2022 recovery picture is much improved from 2021. To make the most of this rising recovery and build your loyalty toward the future, focus on stewarding your customers by doing these five things really well:

- Listening. Stop talking!

- Use some of your communication opportunities and channels to listen and collect responses from your customers rather than talking at them. The data above is, as the name of the tool suggests, a benchmark, but there are unique values and contours within your audience that you should know and understand.

- Measuring. Be consistent.

- Based on your customer feedback, determine the metrics that will drive your decisions and measure them consistently. What are the numbers you want to drive up or down? Look for ways to reduce friction in data collection and sharing amongst your teams. For some additional ideas of metrics you should already be tracking consistently, check out TRG Arts' blog, Measure What Matters: 6 Metrics Arts Leaders Should Track.

- Inviting. Ask them back.

- Invite your customers to return like you know their history. This requires segmented messaging and an organised database, but it allows you to make the right offer to the right patron at the right time. There are nuances to the best way to welcome a first-time attendee or acknowledge and reward loyalty. Taking the time to consider the right way to invite each customer group will show your audiences that they are known and valued.

- Surprising. Delightfully!

- Look for ways to surprise and delight your customers throughout their experience with you. One great example I have seen is placing a gift or a welcome card on the seats of first-time attendees or subscribers. These simple gestures make your customers feel seen and valued as well.

- Evolving. Be ready and willing to change.

- Finally, be flexible and evolve your practices to stay aligned with your customer’s values. As we have seen in the data from The Arts and Culture Benchmark, these values can and do change significantly even over a period of several months. Continuing to listen, measure, invite and surprise will ensure that your organisation continues to create and build loyal customers.

This content was first presented in February 2023 as part of The Future of Audience Loyalty, a panel event hosted by Spektrix. View the full recording and slides below.

THE FUTURE OF AUDIENCE LOYALTY

Eric Nelson is Client Engagement Officer at TRG Arts.

Join TRG's free Arts and Culture Benchmark to understand how your ticketing data compares to an industry leading benchmark of over 400 organizations across North America, the UK and Ireland.

We learn more when we connect. Puzzle through these ideas with Eric by scheduling some time in his calendar.