6 min read

Meeting Audience Needs: Drive loyalty with the right value proposition

The keys to audience loyalty are market research, analysis and segmentation, matching the right value proposition to the right segments of your audience.

Robin Cantrill-Fenwick, CEO of Baker Richards, outlines the motivations and mental triggers that inspire loyalty in your audiences, explores drivers for reattendance, and shares a three-step model to create a value proposition that meets the needs of both your audiences, and your organisation.

This content was first presented in February 2023 as part of The Future of Audience Loyalty, a panel event hosted by Spektrix. If you missed out, we've now published the full event online - helping you to explore what customer loyalty means for theatres, cultural venues and touring organisations in the post-pandemic world.

Defining loyalty

Understanding the triple motivations of Utility, Belonging and Reward

Let’s start with something my colleague David Reece wrote recently in Arts Professional. In the years ahead, he anticipates a need to prioritise maintaining and growing audience volume over increasing average yield. There are five key ways to grow admissions volume: Acquisition, Reactivation, Retention, Frequency, and Party Size.

If we remove the first and last – Acquisition and Party Size – the other three points all relate in some way to Frequency of attendance. So when we talk about building an effective loyalty programme, what we really mean, much of the time, is building Frequency of attendance. Loyalty and Frequency are the same thing. Or are they?

How do we create a loyal customer?

A customer makes their first visit to your organisation. You have their contact details. What next?

They make their second booking, hopefully. And this to my mind is the most valuable booking of all. It’s one of the hardest wins; it’s the start of a pattern, not just a chance visit. And it’s the first real opportunity to build frequency and loyalty.

Next - according to traditional models - they might adopt higher value behaviours. They demonstrate loyalty through Frequency of attendance, but also through Tenure – attending over many seasons; Advance bookings – committing several weeks in advance; and Spend – choosing higher price tickets or splashing out in the café or bar. Frequency is part of loyalty. But shouldn't loyalty be about something more – a special relationship, or sense of belonging, perhaps?

Sometimes, yes. But sometimes it’s more prosaic. Recently, I worked with a large visitor attraction, and asked their regular attenders why they kept coming back.

“It’s convenient for me,” they answered. “And the parking’s good.”

Loyalty comes in many forms.

Recognising a loyal customer

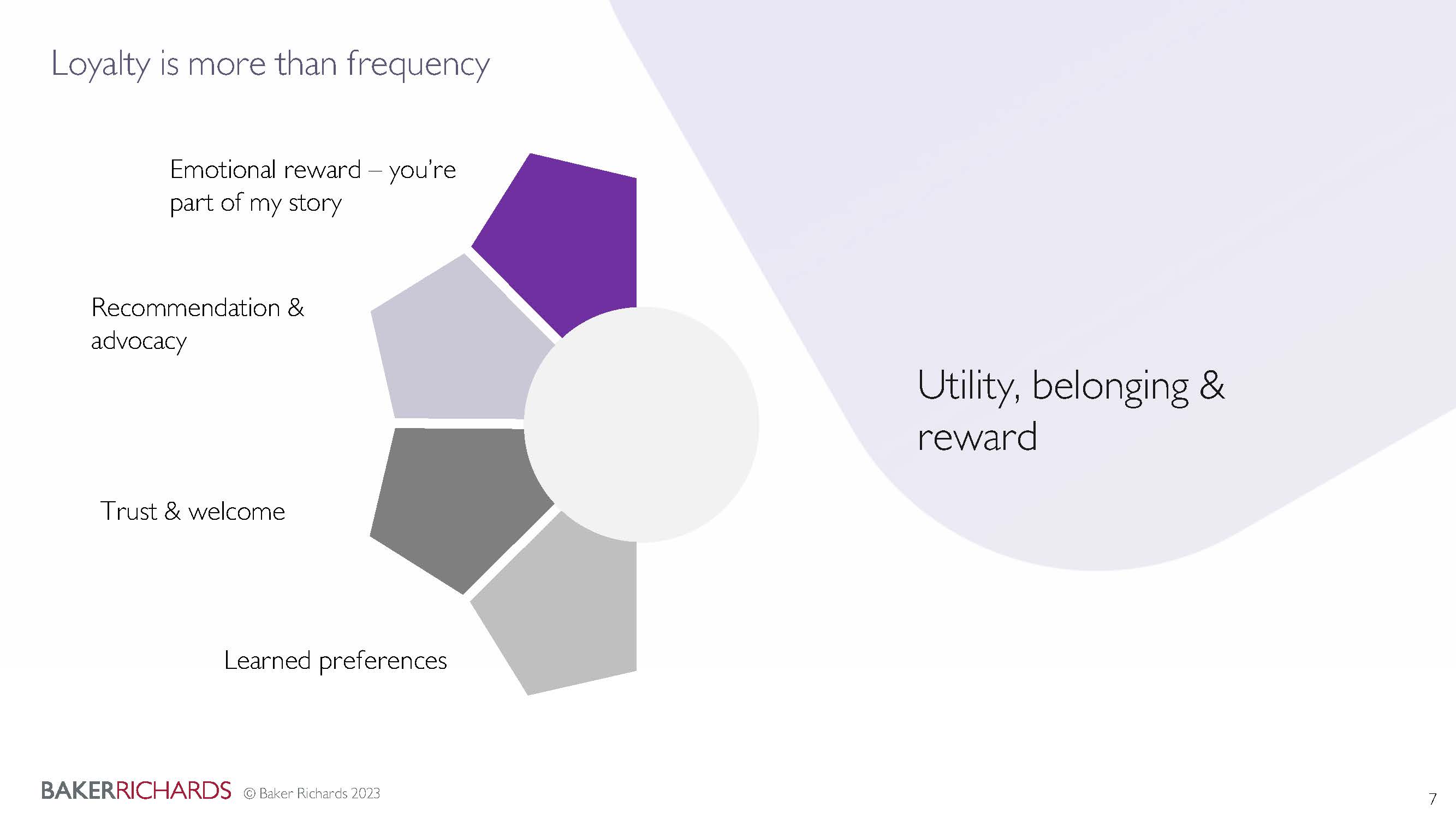

• Learned preferences. They know what they like, which day they like to attend, where they like to sit. They have a favourite member of a staff, and a favourite item on the menu.

• Trust and welcome. Subconsciously, they have a sense that they trust your organisation. They feel safe with you; they have a sense of belonging or welcome when they walk through your doors.

• Recommendation & advocacy. That trust makes them responsive to your communications. They’re more likely than others to act on your recommendations by trying a show or activity; they pick up on implicit messages and become advocates for your organisation.

• Emotional rewards. Their relationship with you may grow into a core part of their identity. Subscribers to the symphony or opera are an important segment of the classical music market; but their subscription is also an important aspect of who they are.

Together, these behaviours map to three motivations: Utility, Belonging and Reward.

But how do we go about finding these people, understanding their individual motivations, and offering them the right rewards?

Identifying loyalty

Use data within and beyond your CRM system to Research, Analyse and Segment

Before thinking about the benefits that matter to your loyal customers, it’s important to define what matters most to you, or brings most benefit to your organisation.

Is it all about booking frequency? Do you want to drive more cross-genre bookings? How important is it that ticket buyers also participate in your community activities? Do you want to build donations, memberships, or advocacy?

Clarity on these questions will give you clarity on your objectives for building loyalty, and the key results and measures you’re looking for once you begin.

The next step might be to send out a brochure about your memberships, donations or subscriptions, targeting your most frequent attenders. The more they engage with your programme, the hotter a loyalty prospect they become.

But first take a look at some research from the wider sector, and make sure the offer in your brochure is likely to meet their needs. Are your pre-pandemic loyalty models still effective in 2023?

Do customers want to become subscribers?

Let’s look at some data shared by JCA Arts Marketing - our partners in the US - analysing subscription sales over the last year.

Fixed Series subscriptions see customers choosing a static package, and locking in their date and seat choices early in the year. Takeup of these subscriptions is declining, and the rate of decline is getting faster.

Flexible subscriptions enable customers to build their own season bundle, giving them the option to change their mind, commit closer to the event date, and sometimes to pay by instalments. Takeup of flexible subscriptions is growing.

The decline in fixed series subscriptions is faster than the growth in flexible subscriptions – it’s not like for like. So where do new subscribers come from? Is it always those ‘hot prospects’ who become subscribers, as we might expect?

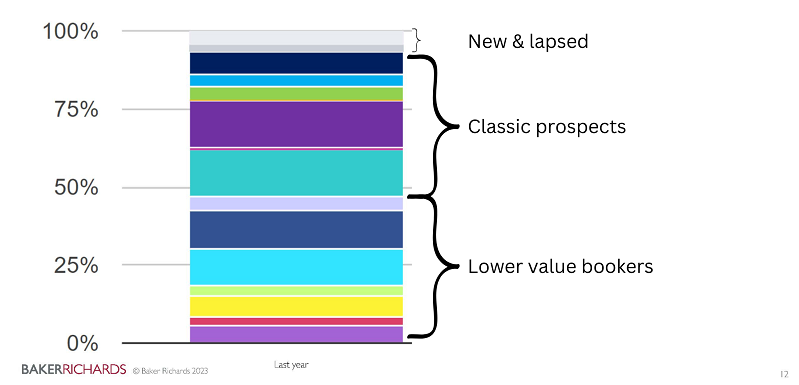

Well – no. This year’s flexible subscribers were doing all sorts of things last year.

• Around 45% were classic subscription prospects – high value bookers, regular attenders, or Fixed Series subscribers who decided to switch to a more flexible option.

• A similar number came from lower value segments – occasional bookers, or low-tier ticket buyers, who moved straight into subscriptions.

• The final 10% or so were completely new to file or lapsed bookers – people who’d never attended that organisation, or hadn’t visited for years. In one organisation, a massive 48% of subscribers were new to file.

What makes customers become subscribers?

Again, it’s important not to underestimate the prosaic reasons for customers to become members or subscribers. A few years ago, Baker Richards worked with the Royal Academy to understand engagement with their summer exhibition. And we found that as soon as the day’s ticket sales rose above 1900 or so, membership sales multiplied. There was a direct correlation between the length of the queue, and the number of people willing to buy an £85 membership in order to skip it. Standard tickets for the exhibition cost £12, so that was an increase of over £70 – just to avoid standing in line.

So start with research outside your own database – what do audience behaviours look like around the world, and how can you reach people who aren’t already in your system?

Then explore your database. Use tools like autotags and reporting in Spektrix to quickly identify your hot prospects, the people ready to engage with your loyalty models – and those who are ready to move away from them. It’s just as important to understand why loyal customers lapse, as why they subscribe.

Turn these lists into segments. This is the most important step you can take to inspire and build loyalty. Once you’ve segmented your audience, you’re ready to explore how each segment interacts with your organisation, and match their motivations to your business priorities.

Inspiring Loyalty

Drive loyalty in each segment by Creating, Communicating and Matching your value to their needs

First, understand what a realistic target looks like. Once you’ve created a measurable loyalty programme, how will you know how effectively it’s performing?

I looked at a small sample of performing arts organisations in the UK to understand how loyalty related to overall ticket value. These figures were probably higher pre-pandemic, but that doesn’t make them insignificant now.

The top 20% of bookers account for well over 50% of total sold ticket value. I broke down that figure to see what it looked like for different types of arts organisation.

Value of tickets sold to the top 20% of bookers

-

-

Concert hall: 48%

-

Mid/large-scale theatre: 59%

-

Opera house: 63%

-

Small-scale theatre: 72%

-

Offer the right rewards to each audience segment

To match or exceed these industry averages, you should start by understanding each segment of your audience – who they are, what they stand to gain, and what prevents them from booking. Consider the jobs they do; how you fit into their other priorities; and what they want from you or your programme – are they looking for entertainment, learning opportunities, or social activity? And if they’re not coming as often as they might, try to understand why – is it time, money, or insecurity that prevents them from coming along?

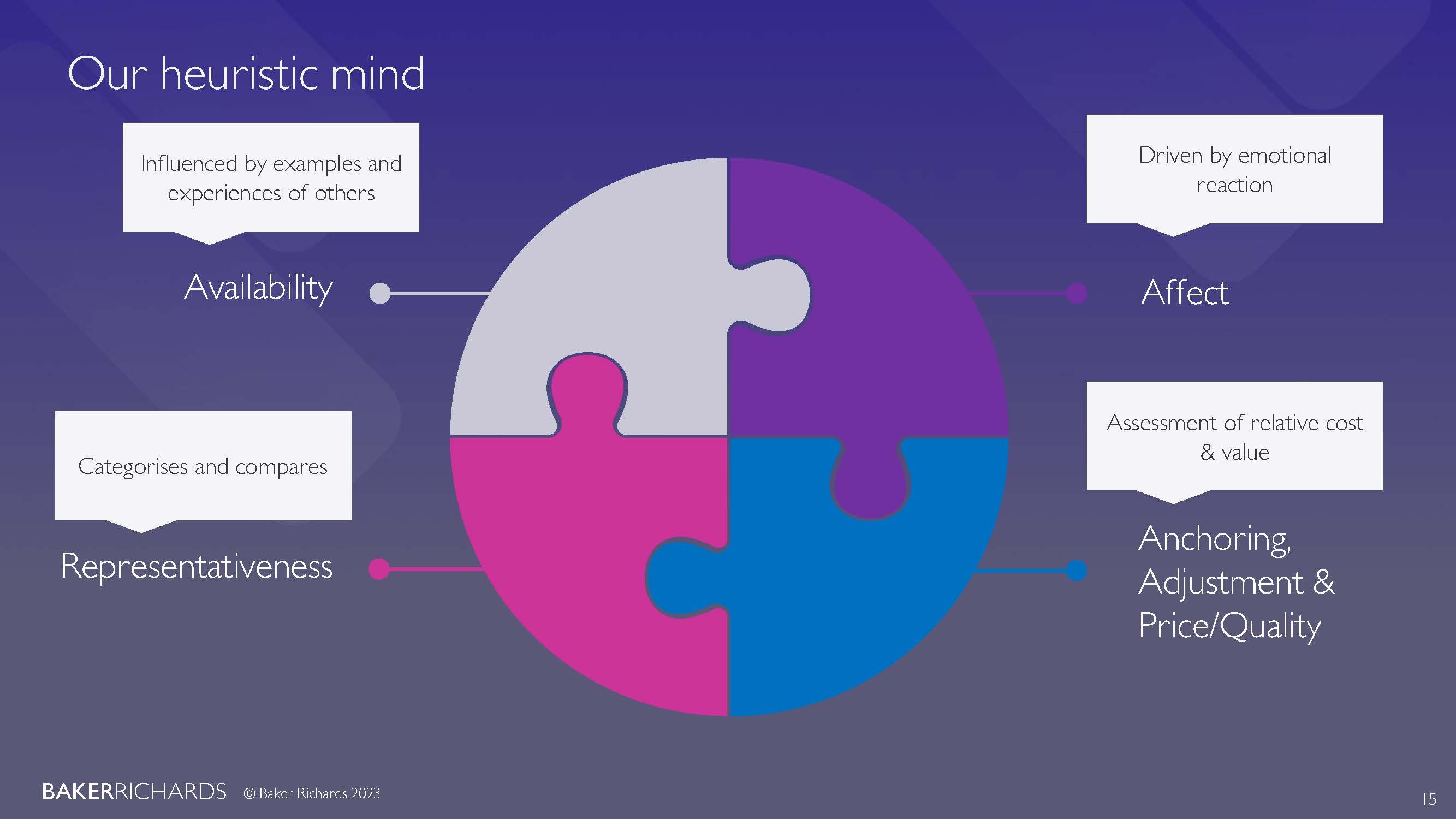

For each segment, think about four facets of the heuristic mind – the triggers or mental shortcuts that help us make judgments quickly and efficiently. These are the triggers that make people pay £70 extra to jump a queue, or upgrade to a VIP package in response to an on-screen prompt. Loyalty is about repeatedly firing up the parts of the brain that think fast and are particularly driven by reward.

The four facets of the heuristic mind

Availability: We’re influenced by examples, and the experiences of others – we’re driven by word of mouth.

Representativeness: We categorise and compare experiences, deciding how they measure up and assigning value.

Affect: We’re driven by emotions and feelings; if a visit to your organisation feels good, we’ll come again.

Anchoring, adjustment & price/quality: We’re attracted by a good deal or an increase in quality.

But really we can simplify this back to where we started. Utility, Belonging, and Reward, or some unique combination of all three. Once we understand which facets matter most to each segment, we can come up with a value proposition to fire up the heuristic triggers. And that's the key to meeting our audiences' needs, and ensuring our own organisational needs are fulfilled at the same time.

This content was first presented in February 2023 as part of The Future of Audience Loyalty, a panel event hosted by Spektrix. View the full recording and slides below.

THE FUTURE OF AUDIENCE LOYALTY

Robin Cantrill-Fenwick is the CEO of Baker Richards.